Blog Post from September 25, 2023 by Bart DeCanne

100% Net Return...in 11 Months, and Audited

100% net return...in 11 months, and a report from an independent auditor

Fund performance

As of end of August 2023, the OptionAgent hedge fund exceeded 100% time-weighted return, net of all fees and expenses. This means any dollar invested in the fund from when fund trading started early October 2022 has doubled...in just 11 months.

A prior blogpost from April noted a 55% net return after 6 months, so this new milestone is a great opportunity to provide a performance update. Furthermore we can now also state that fund results have been confirmed by an independent auditor, more about this later in this post.

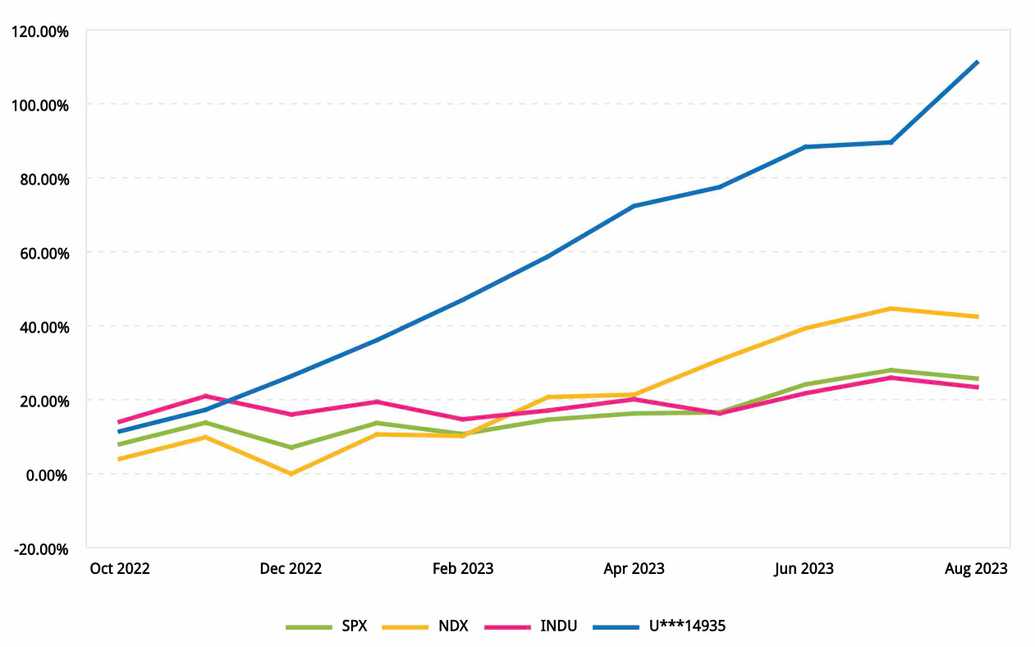

The figure shows the cumulative gross fund return vs benchmarks (SPX=S&P500, NDX=NASDAQ-100, INDU=Dow Jones Industrials) over the period Oct 1 2022 thru Aug 31 2023. Gross return is the time-weighted1 return of the pooled brokerage account that holds >99% of the fund's assets (the remaining <1% is held as cash in a bank account to cover day-to-day expenses).

The table and figure are sourced from a PortfolioAnalyst report. PortfolioAnalyst is a GIPS2-compliant reporting tool offered by our fund's brokerage partner.

Gross return is 111% over these 11 months. The net return is calculated by the fund's 3rd party administrator after taking into account all expenses charged to the fund, and the aggregate of performance and management fees charged to the various capital accounts of the fund's limited partners. We update net performance, both YTD and over the fund's lifetime, every month on the homepage of this website. Net returns are sourced from the monthly fund statement that you can find in the Downloads section of the site.

More about gross vs net returns, fund expenses and how limited these are, later in this post...

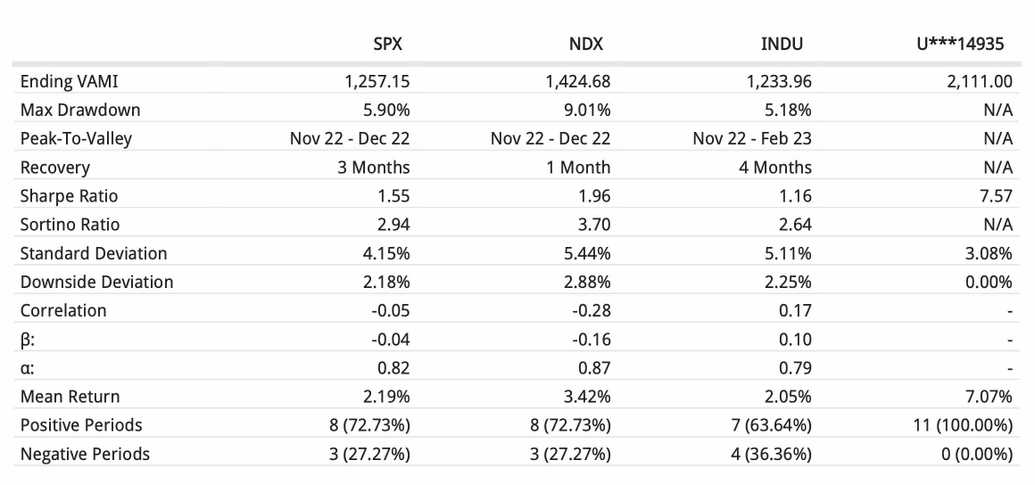

The risk analysis table shows some revealing stats. The one parameter savvy investors look for is the Sharpe ratio, as it measures the raw cumulative return vs an implicit risk derived from variations of returns across reporting intervals (1 month). Generally a Sharpe ratio higher than 1 is good as it means the return is higher than what would be needed to overcome any return variations, while anything above 2 is excellent. (I'm a bit loose here with the Sharpe ratio definition to avoid having to go into risk-free rates and standard deviations).

Over the 11 months of trading considered here, the Sharpe ratio was off-the-charts at 7.57!

It is also worth noting that the fund did not have any negative month to date: gross monthly performance has varied from 0.7% to 11.5% with an average of 7.1% . This compares to monthly returns of the S&P500 between -5.9% (Dec 2022) and +7.99% (Oct 2022) over the same timeframe (S&P500 average monthly return: 2.2%).

Since there has been no negative month to date, the Sortino ratio (which unlike the Sharpe ratio only penalizes negative return variations as obviously positive variations are a good thing) is shown as N/A.

True to its hedge fund designation, the OptionAgent strategy is low or even negatively correlated to the market. Unsurprisingly given its higher volatility, the largest negative correlation is with the tech-heavy NASDAQ. This makes the fund an excellent hedge if you have a long portfolio of (technology) stocks. The low and negative market correlation is further evident from the low (negative) beta vs these market indices, while alpha is consistently positive.

Report from independent auditor

Although there is a multi-year trading history prior to the fund's inception from a personal account in which the strategy was developed (see this blogpost), the actual fund only started trading on October 1 2022 (technically our first trade happened on Sunday evening October 2 2022 shortly after the option market opened in the overnight session).

While we are required as a hedge fund operating in California to file annually an independent auditor report from a PCAOB3-certified auditor, the fact that we only covered 3 months of trading in 2022 allows us to postpone a first audit until Q1 2024 and then cover 15 months of trading.

However to validate the results of our initial 9 months (Oct 2022 thru e/o June 2023) we decided to order a mid-year audit report in July.

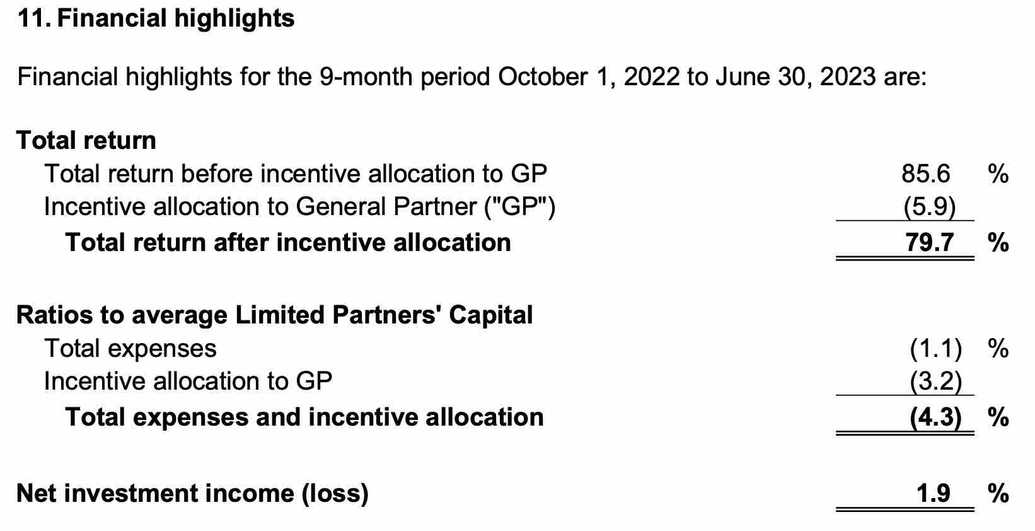

For ~8 weeks, the auditor verified, amongst other things, fund registrations and filings, fund money in- and outflows to its bank and brokerage accounts, fund expenses, a random sampling of order tickets, trade executions and trade commissions on the more than 2000 option orders placed in those 9 months of trading, monthly balance sheet, P&L and income statements, calculation of management and incentive allocation fees, and the splits of income and fees to each capital account.

We are very pleased to report that the auditor confirmed the ~85% gross fund return over these 9 months and that there were no changes to the NAV of the overall fund, or any of our LPs monthly statements. As part of its 'subsequent events' verification, the auditor also verified fund in- and outflows until the date of the audit report (Sept 6 2023) and found no discrepancies to fund policies.

These are the Financial Highlights from the audited financial statements. This also confirms the very low expense ratio of the fund.

We have published an excerpt of the audit report (table of contents and the opinion of the auditor) elsewhere on our website, see under Downloads. The full report is available to our current investors, and to qualified future investor prospects, as part of our private offering documentation.

Conclusion

While past performance is not necessarily a guarantee for future results, the expectation of a macro-environment in which interest rates will stay higher for longer (the main conclusion of the most recent Fed meeting on Sept 19 & 20 2023) should bode well for a fund like ours that optimizes a volatility-based strategy, further enhanced by A.I., and benefits from higher interest rates on its cash balances that at all times secure the option positions held.

Note 1: Time-weighted return is independent of money in- & outflows and basically represents the performance of the first dollar invested in the fund.

Note 2: GIPS = Global Investment Performance Standards

Note 3: PCAOB = Public Company Accounting Oversight Board

Tagged in: